Trace Zero Fundamentals Explained

Table of ContentsWhat Does Trace Zero Do?Little Known Facts About Trace Zero.Trace Zero Can Be Fun For AnyoneThe Definitive Guide for Trace ZeroOur Trace Zero PDFs

Carbon accounting enables organizations to do well in the net-zero transition and handle climate-related risks. Organizations with robust carbon accounting methods are better placed to fulfill demand from customers, investors and regulators (like the EU CBAM and UK CBAM), and can determine dangers and competitive possibilities. Nonetheless, there are limitations to carbon audit if it's refrained from doing correctly.Organizations need to use their carbon bookkeeping data and insights to take the best steps., and less than half are determining their supply chain discharges.

Residual mix variables resemble grid-average elements but are computed based upon electricity generated from non-renewable resources, as an example, oil, gas, coal or various other resources not backed by EACs. If residual mix aspects are not offered for a region, then typical grid-average aspects ought to be utilized, due to the fact that they are in the conventional location-based approach.

The Single Strategy To Use For Trace Zero

Factor 5 calls for that certificates be sourced from the exact same market in which the reporting entity's electricity-consuming operations lie and to which the instrument is used. This suggests that it would be wrong to designate certifications provided in the United States to consumption in the UK (carbon footprint tracking). If the organization has power purchase contracts, the certificates may not exist

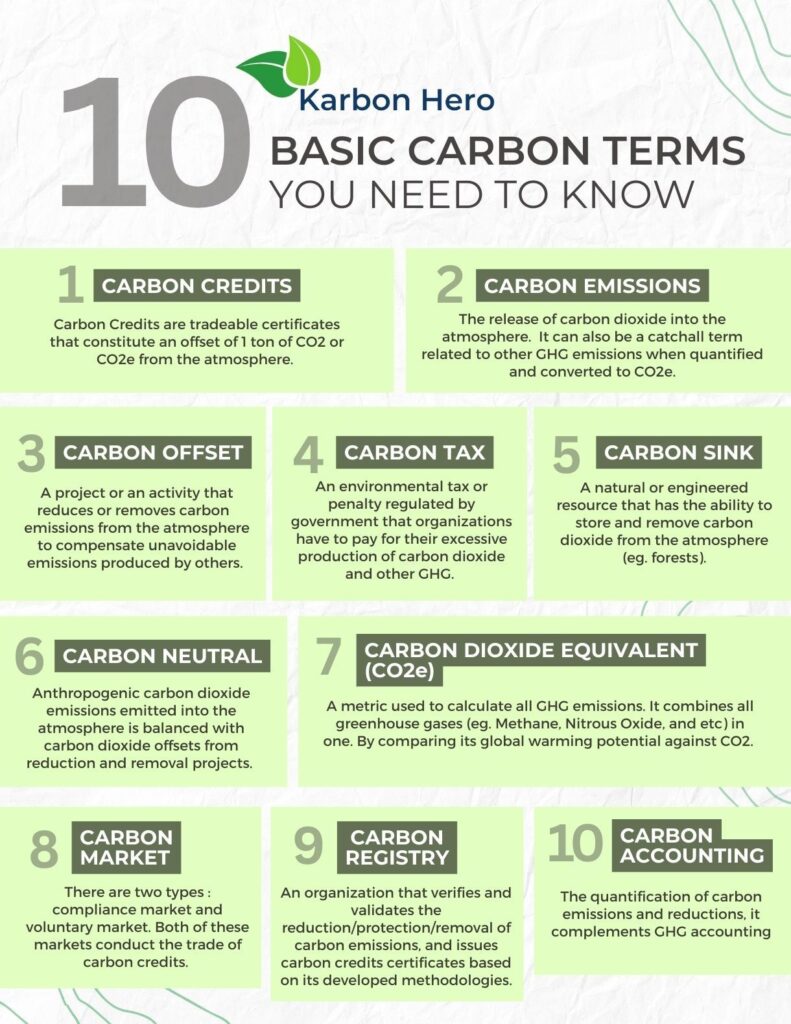

Baseline-and-credit systems, where standard discharges levels are defined for individual regulated entities and credit histories are issued to entities that have actually lowered their discharges listed below this level. It is different from an ETS in that the discharge decrease result of a carbon tax obligation is not pre-defined but the carbon cost is. Crediting Systems problem carbon credit histories according to a bookkeeping method and have their own pc registry.

For governments, the option of carbon prices type is based on national circumstances and political truths - zero footprint carbon calculator. In the context of obligatory carbon rates efforts, ETSs and carbon taxes are the most common types. The most ideal campaign kind relies on the certain circumstances and context of an offered jurisdiction, and the tool's policy purposes need to be straightened with the wider nationwide economic priorities and institutional capabilities

Indirect carbon rates efforts are not currently covered in the State and Trends of Carbon Rates collection and on this site.

About Trace Zero

Carbon audit actions discharges of all greenhouse gases and consists of Carbon dioxide, methane, nitrous oxide, and fluorinated gases. Gases various other than carbon are revealed in terms of carbon matchings.

For example, in 2012, the UK union federal government introduced compulsory carbon reporting, calling for around 1,100 of the UK's largest provided companies to report their greenhouse gas exhausts annually. Carbon accounting has actually since risen in significance as more regulations make disclosures of exhausts required. Thus, there is an upward fad in coverage demands and regulations that require companies recognize where and just how much carbon they produce

ESG frameworks measure a service's non-financial efficiency in environmental, social and administration groups. Carbon accounting is a vital element of the E, 'Environment', in ESG.

The smart Trick of Trace Zero That Nobody is Discussing

A carbon equivalent is determined by transforming the GWP of other gases to the equal amount of co2 - trace carbon solutions. As pressure climbs to reduce exhausts and reach enthusiastic decarbonisation goals, the duty of carbon accounting is increasingly crucial to a company's success. Along with climate pledges and regulatory restraints, the rate of carbon is steadily rising and this further incentivises the private sector to gauge, track and reduce carbon discharges

Carbon accounting enables business to try this website identify where they are releasing the most discharges. Carbon audit is the first and important step to exhausts reduction, which is essential if we desire to remain below 2 levels of global warming.